This section consists of Database Things and fields description for every thing which is part of the template.

Introduction

To get to the Data section, click the database icon on the left side tabs in Bubble Editor.

See Bubble manual information when working with data:

https://manual.bubble.io/help-guides/working-with-data;

https://manual.bubble.io/core-resources/data.

Data Types

Note: In case you have accidentally deleted a data type - no worries! Bubble lets you restore💪the deleted data type.

Clicking on 'show deleted types' or 'show deleted fields' from the Data → Data types tab will reveal the deleted items, and a 'restore' button will appear next to each deleted entry. Simply click 'restore', to restore a field or data type.

Tip: Aside from the below-listed data types and fields, Bubble creates these default fields visible in each data type:

Creator, Modified Date, Created Date and Slug, except for the User data type. The User data type will have the following fields: email, Modified Date, Created Date and Slug.

These fields' values can be used in workflows, conditional formatting, etc. To learn more, see the Bubble manualAdminRights

This data type is storing information regarding the admin rights that can be enabled for admin users to access the admin panel and use its features.

Field Name | Type | Notes |

AdminRights | yes / no | Indicates if admin users can use their rights. |

Bank_account

Bank_accounts represent and hold information about bank accounts authenticated via plaid.

They contain some reference information like

name, type, sub_type and some important tokens and ids for Plaid calls.Field Name | Type | Notes |

dwolla_source_link | text | Stores the Dwolla source link |

name | text | Stores the account name. |

number_ending | text | Stores ending number. |

plaid_account_id | text | Stores the Plaid account ID. |

plaid_token | text | Stores the Plaid token. |

stripe_bank_id | text | Stores the Stripe bank ID. |

stripe_connect_bank_id | text | Stores the Stripe Connect bank ID. |

stripe_token | text | Stores the Stripe token. |

sub_type | text | Stores the bank account sub type. |

type | text | Stores the bank account type. |

Investment

Investments represent the amount of money used to fund a loan. They contain information about the investment like

amount, share of loan amount, total_interest_gained, loan_id status etc. Field Name | Type | Notes |

amount | number | Stores the investment amount. |

date_completed | date | Stores the date of completion. |

date_invested | date | Stores the date when invested is made. |

date_started | date | Stores the date when investment started. |

grade | text | Stores the investment grade. |

id | text | Stores the investment id. |

investor_email | text | Stores the investor email. |

investor_name | text | Stores the investor name. |

loan | loan | Stores the loan. |

loan_id | text | Stores the loan id. |

rate | number | Stores the investment rate. |

share | number | Stores the share value. |

status | text | Stores the investment status. |

term_months | number | Stores the number of term months. |

total_interest_gained | number | Stores the value of total gained interest. |

total_return_amount | number | Stores the value of total return amount. |

Loan

Loans represent loan offers or actual loans given to borrowers on the platform. They contain information about the loan like amount, interest rate, relevant dates, and many other fields most of which are annotated in the editor.

Field Name | Type | Notes |

amount | number | Stores the loan amount. |

application_step | number | Stores the number of applications steps. |

apr | number | Stores the APR. APR is the annual cost of a loan to a borrower — including fees |

available | yes / no | Stores the availability status. Default value - yes. |

borrower | User | Stores the borrower user. |

borrower_email | text | Stores the borrower's email. |

borrower_name | text | Stores the borrower's name. |

charge_off_date | date | Stores the charge off date. |

current_other_amount | number | Stores the other amount |

current_payment_amount | number | Stores the current payment amount. |

current_payment_type | text | Stores the current payment type. |

current_payoff_amount | number | Stores the current payoff amount. |

denial_date | date | Stores the denial date. |

funded | yes / no | Stores the loan status. |

funded_date | date | Stores the loan funded date. |

funding_amount | number | Stores the funding amount. |

funding_percentage | number | Stores the funding percentage. |

grade | loan_grade | Stores the loan grade. |

id | text | Stores the loan id. |

interest_balance | number | Stores the interest balance. |

interest_rate | number | Stores the interest rate. |

investment | Investment | Stores the related investment. |

listed | yes / no | Stores the loan listing status. |

listing_end_date | date | Stores the listing end date. |

listing_start_date | date | Stores the listing start date. |

loan_agreement | file | Stores the loan agreement. |

months_since | number | Stores the number of months since loan taken |

next_monthly_payment | number | Stores the amount of next monthly payment. |

next_payment_date | date | Stores the next payment date. |

origination_date | date | Stores the loan origination date. |

paid_date | date | Stores the date to be paid. |

payments | List of monthly_payments | Stores the list of monthly payments. |

principal_balance | number | Stores the number of principal balance. |

purpose | text | Stores the loan purpose. |

rating | text | Stores the loan rating. |

repayment_wf_id | text | Stores the repayment workflow id. |

status | text | Stores the loan status. |

submitted_date | date | Stores the date when submitted. |

TemporaryFundingSchedule | text | Stores the temporary funding schedule. |

term_months | number | Stores the term in months. |

total_interests | number | Stores the total number of interests. |

total_interests_paid | number | Stores the number of total interests paid. |

total_paid | number | Stores the number of total paid. |

total_payments_made | number | Stores the number of payments made |

total_repayment_amount | number | Stores the total repayment amount |

total_to_return | number | Stores the total to return. |

verification_stage | number | Stores the verification stage number. |

Loan_grade

Loan_grades or Ratings are guides used to help determine the interest rate to be offered to an intending borrower based on their credit score.

Each loan_grade has a

min and max credit score field and borrowers that have scores within that range will have the loan_grades' interest_rate applied to their offers.Field Name | Type | Notes |

Interest_rate | number | Stores the interest rate. |

label | text | Stores the loan grade label. |

max | number | Stores the max loan number. |

min | number | Stores the min loan number. |

Log

This data type is collecting logs.

Field Name | Type | Notes |

current balance | text | Stores the user’s current balance. |

current pending balance | text | Stores the user’s current pending balance. |

Date started | date | Stores the loan date started. |

name | text | Stores the name. |

transfer Amount | text | Stores the transfer amount |

transfer ID | text | Stores the transfer ID. |

Monthly Payment

Monthly_payments are the regularly scheduled payments that are made over the term of the loan. They are created every month with the first one created right after the related

loan is originated. At the same time, an API workflow is scheduled for 1 month ahead which makes the Stripe charge on the user's

default_bank_account, creates a new monthly_payment and schedules itself again for 1 month ahead.Field Name | Type | Notes |

amount | number | Stores the monthly payment amount. |

balance | number | Stores the balance. |

date | date | Stores the monthly payment date. |

date_paid | date | Stores the date when paid. |

incoming_payment_id | text | Stores the incoming payment id |

interest_balance | number | Stores the interest balance. |

interest_portion | number | Stores the interest portion. |

loan | loan | Stores the related loan |

principal_balance | number | Stores the principal balance. |

principal_portion | number | Stores the principal portion. |

status | text | Stores the monthly payment status. |

Team_member

This data type stores the team members’ information.

Field Name | Type | Notes |

designation | text | Stores the team member designation. |

name | text | Stores the team member name. |

photo | image | Stores the team member photo. |

serial | number | Stores the team member serial number |

Transaction

Transactions are used to track all major financial operations on the platform which are loan payments, account funding, and withdrawals.

Field Name | Type | Notes |

amount | number | Stores the transaction amount. |

bank | bank_account | Stores the related bank account. |

card | card | Stores the related bank card |

date_completed | date | Stores the transaction completion date. |

loan | loan | Stores the related loan. |

loan_id | text | Stores the related loan ID. |

method | text | Stores the transaction method. |

reference | text | Stores the transaction reference. |

status | text | Stores the transaction status. |

type | text | Stores the transaction type. |

user_email | text | Stores the user email. |

US_State

This data type stores information regarding US states.

Field Name | Type | Notes |

Code | text | Stores the US state code. |

Name | text | Stores the US state name. |

User

Users are either investors or borrowers on the platform. They store the usual profile info (Photo, Name, Email Address), more detailed personal info (Address, Income, etc), payment- related info (Bank accounts, cards), role-specific objects (

investments or loans), and a host of other things.Field Name | Type | Notes |

accounts | List of bank_accounts | Stores the list of related accounts. |

additional_yearly_income | number | Stores the additional yearly income. |

alternate_current_loan_request | loan | Stores the current loan request. |

cards | List of cards | Stores the list of owned cards. |

cash_balance | number | Stores the cash balance amount |

city | text | Stores the user’s city. |

current_loan_request | loan | Stores the current loan request. |

date_of_birth | date | Stores the date of birth. |

default_bank_account | bank_account | Stores the default bank account. |

default_card | card | Stores the default card. |

dwolla_customer_link | text | Stores the Dwolla customer link. |

employer_name | text | Stores the employer name. |

employer_phone | text | Stores the employer phone. |

employment_start_month | text | Stores the employment start month. |

employment_start_year | text | Stores the employment start year. |

employment_status | text | Stores the employment status. |

first_name | text | Stores the first name. |

gov_id | image | Stores the type of ID document. |

gov_id_back | image | Stores the back side of ID document. |

gov_id_front | image | Stores the front side of ID document. |

id_verified | yes / no | Stores the ID document verification status. |

investments | List of investments | Stores the list of investments. |

investor_signup_step | number | Stores the number of investor signup steps. |

is_admin | yes / no | Indicates if the user is admin or not. |

is_borrower | yes / no | Indicates if the user is borrower or not. |

is_investor | yes / no | Indicates if the user is investor or not. |

kyc_status | text | Stores the KYC status. KYC means Know Your Customer and sometimes Know Your Client.

KYC or KYC check is the mandatory process of identifying and verifying the client's identity when opening an account and periodically over time. In other words, banks must make sure that their clients are genuinely who they claim to be. |

last_name | text | Stores the last name. |

loan_grade | loan_grade | Stores the loan grade. |

loans | List of loans | Stores the list of loans. |

location | text | Stores the user location. |

mobile | text | Stores the mobile phone. |

monthly_housing_payment | number | Stores the monthly housing payment. |

occupation | text | Stores the user’s occupation. |

payslip | image | Stores the payslip. |

payslip_verified | yes / no | Stores the payslip verification status. |

pending_cash_balance | number | Stores the amount of pending cash balance. |

phone | text | Stores user’s phone. |

ssn | text | Stores the user’s SSN |

state | text | Storest the user’s state. |

state_code | text | Stores the state code. |

street_address | text | Stores the street address. |

stripe_customer_id | text | Stores the Stripe customer id. |

stripe_seller_id | text | Stores the Stripe seller ID. |

us_state | US_state | Stores the name of US State. |

withdrawals | List of withdrawals | Stores the list of withdrawals. |

work_phone | text | Stores the work phone. |

yearly_income | number | Stores the yearly income. |

zip_code | text | Stores the zip code. |

Withdrawal

Withdrawals are used to handle fund withdrawals by investors. They contain information like

amount, reference, destination bank_account, status etc.Field Name | Type | Notes |

amount | number | Stores the withdrawal amount. |

approved_date | date | Stores the withdrawal date of approval. |

bank_account | bank_account | Stores the related bank account. |

id | text | Stores the withdrawal ID |

reference | text | Stores the withdrawal reference. |

status | text | Stores the withdrawal status |

success_date | date | Stores the withdrawal success date. |

transaction | transaction | Stores the related transaction. |

user_email | text | Stores the user email. |

user_name | text | Stores the user name. |

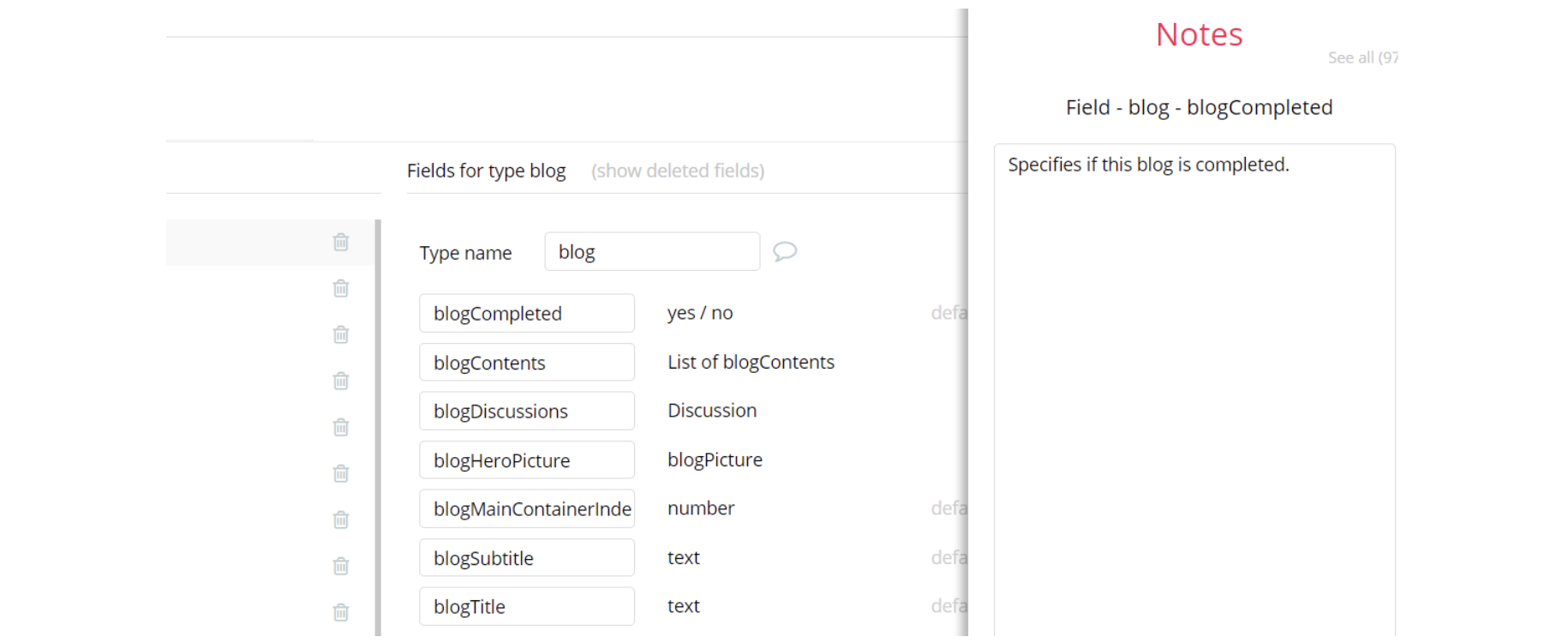

Embedded Notes in Bubble Editor

This template comes with explicit Notes for Database fields, Option sets and their fields, and Privacy rules, which will guide you with the modification process.

In order to preview a Note of any data type or field, click on the 💬 icon.